GET YOUR FREE QUOTE COMPARISON

If you are coming up on your 65th birthday, and have checked out what Original Medicare Part A and Part B doesn’t cover, you’ll likely be shopping for a Medigap plan soon.

Although Original Medicare is a fairly comprehensive federally sponsored health insurance program, there are still gaps in coverage that will force you to pay out-of-pocket for many healthcare services.

Easy Article Navigation

- What is Medigap Insurance?

- What is Covered Under Medigap Plan A?

- What is Not Covered Under Medigap Plan A?

- Medigap vs Medicare Advantage

- Can I change from Medigap Plan A to a better Medigap Plan?

- How to Buy Medigap Insurance?

A Medigap Plan from a private insurance company can be an inexpensive add-on to your Original Medicare coverage that can fill in the gaps in Original Medicare and reduce your out-of-pocket healthcare expenses dramatically.

Since there are many plans to choose from, you can find out about each plan quickly by doing some research at HealthPlans2Go.com.

What is Medigap Insurance?

Simply put, Medigap Insurance (Medicare Supplement Insurance) is a supplemental insurance plan that fills the gaps caused by deductibles, coinsurance, and copayments in Original Medicare.

Medigap does not, however, add additional coverages such as prescription drug coverage, dental coverage, or vision and hearing coverage.

Although sold by private insurance companies, all Medigap plans are the same with each company because they are controlled by (standardized) the federal government and state governments.

Currently, there are 10 plans available in the majority of states, with each plan assigned a letter that corresponds with the level of benefits available to the policyholder.

Moreover, even though almost every state offers the same standardized plans, Minnesota, Wisconsin, and Massachusetts standardized Medigap plans in their states differently.

Other additional requirements by the federal government are:

- Any private insurance company that offers Medigap, must offer Medigap Plan A

- If an insurer wants to offer more Medigap Plans – it must offer Pan C or Plan F along with any other plans it would like to offer.

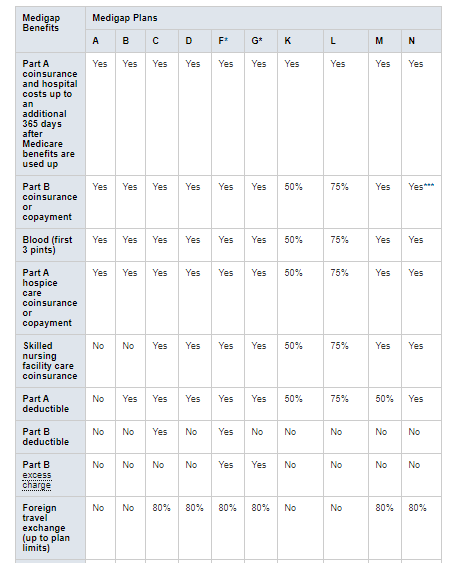

Here is a comparison chart for all Medigap plans that are currently available in most states:

- Medigap Plan F and G are also available as high-deductible plans in several states. The policyholder must meet his or her Medicare-covered costs up to the deductible amount of $2,370 before the policy will pay benefits. Additionally, Plan C and F are not available to applicants who were newly eligible for Medicare on or after January 1, 2020.

What is Covered Under Medigap Plan A?

Medigap Plan a is the most basic of all the plans available. It is also the least expensive.

Typically, with any insurance product, consumers understand that the rates are generally impacted by the number of coverages found in the policy.

Medigap Plan A covers 100% of these four things:

- The Medicare Part A coinsurance for inpatient hospital care up to an additional 365 days once your Medicare benefits are exhausted.

- The Medicare Part B coinsurance or copayment expenses

- The first 3 pints of blood required in a medical procedure

- The Part A hospice care copayment or coinsurance expense

As we mentioned earlier in the article, these are the basic benefits required in Medigap Plans so every other plan must also provide these coverages.

The other nine plans must contain at least one additional coverage than Plan A, but some cover up to five.

What is Not Covered Under Medigap Plan A?

Since Medigap Plan A is the most basic of all Medigap Plans, and the least expensive, there are other gaps in Original Medicare Part A and B that Plan A does not provide coverage for:

- Skilled Nursing Facility coinsurance

- Medicare Part A deductible ($1,484)

- Medicare Part B deductible ($203)

- Part B excess charges

- Foreign travel medical emergency

While Medigap Plan A is the most inexpensive supplement plan available, it’s important to note that the above-mentioned expenses will have to be covered out-of-pocket and the enrollee must continue to pay their monthly Original Medicare Part B premium.

Although Medigap Plan A only provides basic coverage, it will likely be a good fit for seniors who are healthy and require minimal healthcare services.

And, Plan A may be the best solution for seniors on a very tight budget and need to pay the lowest premium possible.

Medigap vs Medicare Advantage

Medigap (Medicare Supplement) plans work with (supplement) Original Medicare Part A and Part B and fill in the gaps that result from deductibles, copayments, and coinsurance requirements.

A Medigap plan is not considered stand-alone health insurance because the policyholder must remain enrolled in Medicare Part A and Part B.

If you want prescription drug coverage, then you’ll need to enroll in Medicare Part D, and if you want dental coverage, you’ll need to purchase a stand-alone dental plan.

A Medicare Advantage plan (Medicare Part C) actually replaces Medicare Part A and Part B and applicants can also get prescription drug coverage and dental, hearing, and vision benefits built into the plan.

Every Medicare Advantage plan must offer the same coverage that’s provided in Medicare Part A and B, however, most companies also additional coverages as well.

Like Medigap plans, Medicare Advantage policyholders must continue to pay their Medicare Part B premium.

When you enroll in a Medicare Advantage plan, you will still receive your Medicare Part A and Part B coverage, except you’ll receive the coverages through a private insurance company rather than from Medicare.

Can I change from Medigap Plan A to a better Medigap Plan?

Yes, you can change plans and many people do. Most seniors who purchase a Medigap Plan A, do so because they are either very healthy or their budget will not allow them to purchase a more expensive plan.

The good news is that you can switch from one plan to another and change companies anytime you’d like to.

However, your timing may be very important if you want to make a change outside of your Open Enrollment Period (OEP) and you don’t qualify for guaranteed issue rights.

For example, if your insurer takes a rate increase that you cannot afford or if you simply wish to have better coverage, and you make the change outside of your OEP, the company can review your medical records and choose to charge a higher premium or even decline coverage.

To protect yourself from an adverse underwriting decision, simply check with the company you want to change to and verify that they will accept your application and the rate you’ll be charged BEFORE you cancel your current plan.

Click Here to review the qualifications for guaranteed-issue rights.

How to Buy Medigap Insurance?

Shopping for and purchasing a Medigap Plan is an important endeavor that you can simplify by using an experienced and reputable independent insurance broker who represents multiple highly rated companies that offer Medigap Insurance.

Even though the plans are identical from one company to another, each company sets its own pricing and most offer some type of additional benefit.

When you are searching for an independent health insurance broker, check them out to see if Medigap plans are one of their specialties and let them become your advisor and advocate during the shopping, purchasing, and underwriting process.

GET A FREE PLAN COMPARISON!

Schedule a Virtual Appointment Today!