GET YOUR FREE QUOTE COMPARISON

Or Call Us at 888-773-1181

Seniors who are enrolled in Original Medicare have access to healthcare services at very reasonable prices. However, because of deductibles, copays, and coinsurance, Medicare beneficiaries are paying significant money out-of-pocket unless they enroll in Medicare Supplement Plan also known as Medigap.

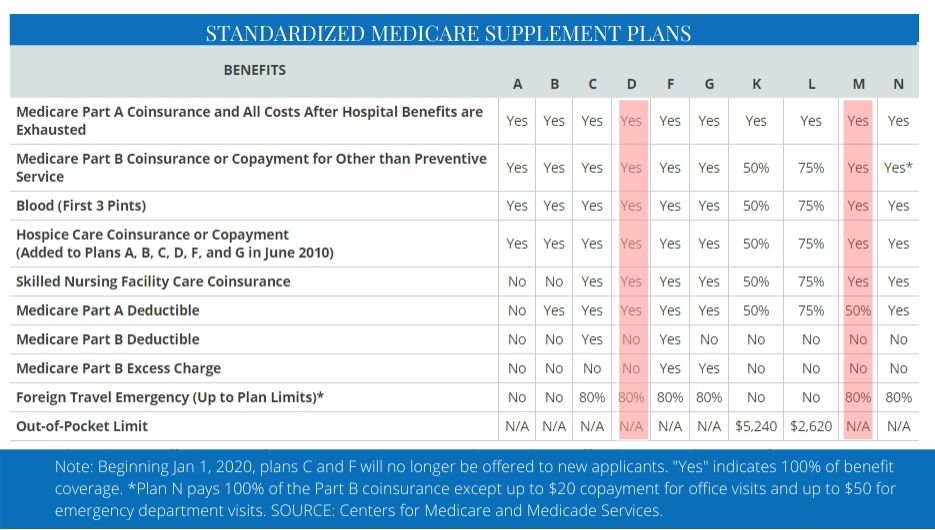

Medicare supplement plans are provided by authorized private insurance companies but the coverage offered in each plan is controlled by CMS (the Center for Medicare and Medicaid Services) and as such, all plans are considered “standardized” and are the same from company to company.

The companies that offer Medicare Supplement plans, however, can set the rates they charge for each plan and offer additional benefits that will help them compete for your business.

In this article, we will drill down into Medicare Supplement plans offered by United Healthcare since they are one of the leading providers nationally.

What We Like about United Healthcare

Although each private insurance company offering Medicare Supplement plans is approved by CMS to do so, as in any industry, some companies do better than others when it comes to pricing, plans offered, and customer service.

If you choose a UnitedHealthcare Medicare Supplement Plan (Medigap), you can expect the following:

> Endorsed by AARP

> Household discounts

> Receive healthcare services from any doctor in the U.S. that accepts Medicare

> Your policy cannot be canceled because of health issues

> A company that is continuously rated very high by the national rating services

> Absolutely no application fees

> 30 days to review your plan (30-day free look)

> Silver Sneakers fitness gym membership in select areas

Some things you’ll want to keep in mind when shopping for UnitedHealthcare Medigap plans:

- Plans offered vary by state

- UnitedHealthcare does not offer Plan D or Plan M

- Available in 35 states only

Which Medigap Plans does UnitedHealthcare Offer?

UnitedHealthcare offers 8 of the 10 standardized plans:

Which UnitedHealthcare Plan is Right for Me?

The reason the CMS is allowing private insurance companies to offer a large selection of plans is so that seniors who have varying circumstances and budgets can choose the right plan for their particular needs:

Seniors Who Prefer the Basic Coverage at the Lowest Cost

Seniors who are in good health and want just a basic plan at the lowest premium are recommended to consider Medigap Plan A or Medigap Plan B.

Seniors With Health Issues and See Physicians and Specialists

Many seniors today are dealing with multiple health issues and in many cases, chronic conditions that need managing are recommended to consider Plan F and Plan G high-deductible plans.

Seniors Who Frequently Travel Abroad

Seniors who have a secondary home overseas or who frequently travel abroad for business or please can find peace of mind knowing they’ll have coverage for foreign medical emergencies should consider Medigap Plans C, F, G, or N since all of these provide benefits that will cover 80% of medical emergencies while out of the country.

When is the Best Time to Buy a UnitedHealthcare Medicare Supplement Plan?

The best time to buy a Medicare Supplement (Medigap) plan is during your open enrollment period (OEP) which starts the month you turn age 65 and enroll in Original Medicare Part B and lasts for 6 months after that date.

During this open enrollment period, applicants will have guaranteed issue rights. This means that the insurance company cannot increase your rate or decline coverage because of health issues.

How to Buy a UnitedHealthcare Medicare Supplement Plan?

Although most companies will provide quotes online or over the phone, the best and quickest method of buying a Medigap plan that is right for you is to contact an independent insurance broker who specializes in health insurance for seniors.

HealthPlans2Go is an independent insurance broker that represents most of the highly-rated companies that offer Medicare Supplement Plans, Medicare Advantage Plans, and Medicare Drug Plans.

We encourage all seniors who are buying Medigap Insurance for the first time or those who have a plan currently and want to look at other options or other pricing.

Although our offices are located in South Florida, the HealthPlans2Go team is authorized to offer Medicare Supplement plans in many states across the U.S.

Senior shoppers can get a free personalized comparison quote by clicking on the quote button below or call us during normal business hours at (888) 773-1181.