Medicare Supplement Plans

Compare PlansMedicare Supplement Plans in 2023

Many folks who are close to age 65 have many things to be thankful for. One of those things is that their health insurance is about to become much more affordable.

For most men and women, the cost of healthcare from age 50 to 64 is almost unbearable, consuming a significant amount of their monthly budget. Even with employer-provided comprehensive health benefits, the out-of-pocket expenses resulting from deductibles, copayments, and coinsurance, increase year over year right along with the cost of medical care.

Now, at age 65, everything changes. After paying into Social Security and Medicare for almost a lifetime, it’s time to collect on that lifelong commitment. Welcome to Medicare!

Easy Article Navigation

- What is Medicare Supplement Insurance?

- Which Medicare Supplement Plan (Medigap) is Best for You?

- Medicare Plans in Massachusetts

- Medicare Plans in Minnesota

- Medicare Supplements in Wisconsin

- What a Medigap Plan will Not Cover

Is Medicare all I need?

Although Medicare Part A and Part B provide comprehensive healthcare coverage for inpatient and outpatient medical expenses, there are some “gaps” in the coverage that are primarily attributable to deductibles, copayments, coinsurance, and some medical expenses that are not covered.

Even with these coverage gaps, the coverage we get from Medicare Part A and Part B is considered a bargain compared to what we were paying from age 50 to 64. But, we must also take into consideration that most of us are no longer working and our incomes are now static while healthcare costs continue to rise.

Many years back the private insurance industry realized these coverage gaps leading to significant out-of-pocket expenses would likely have a substantial impact on Medicare enrollee’s monthly healthcare expenses and thus, Medicare Supplement Insurance was created.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) was created to fill the coverage gaps in Original Medicare. Although these supplement plans are issued and serviced by private insurance companies, they are under the oversight of the federal government’s Centers for Medicare and Medicaid Services (CMS) which has set out guidelines for minimum benefits that each plan must provide and how they are administrated.

Private insurance companies can, however, set their pricing and choose which plans they wish to offer (there are 10 in 2021). They must, however, offer Medicare Supplement Plan A in every state they do business in.

Currently, standardized Medicare Supplement Plans are available in 47 states with only 3 states, Massachusetts, Minnesota, and Wisconsin, electing to have a different set of standardized plans for their residents.

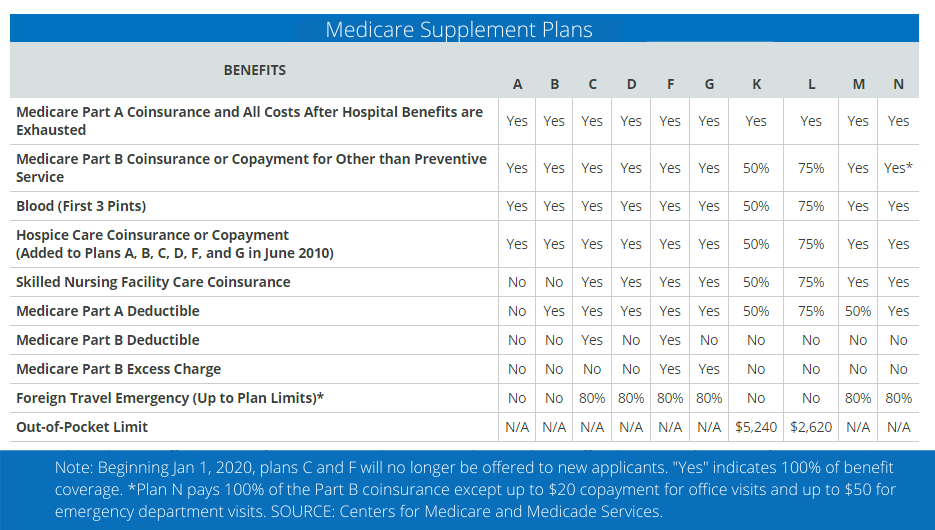

Standard Medicare Supplement Plans (Medigap) for 2023

Which Medicare Supplement Plan is best for You?

Finding the right Medicare Supplement Plan is more than just the lowest premium. To help you determine which plan is best for you, there are three primary issues you should consider.

Benefits

All standardized Medicare Supplement Plans must cover all or some of the following:

- Medicare Part A coinsurance costs up to an additional 365 days after your Medicare benefits are exhausted

- Medicare Part A hospice care copayments or coinsurance

- Medicare Part B (outpatient and doctor visits) copayments and or coinsurance

- The first 3 pints of blood used in a medical procedure

These are the minimum coverages only (Plan A). Plans B through M, however, provide additional coverages and at additional levels. We suggest that you consider your current health condition when electing which additional coverages you feel you’ll need to be covered going forward.

Monthly Premiums

If you elect to purchase a Medicare Supplement Plan you must continue to pay your Part B premium to Medicare. The premium for the Medicare Supplement (Medigap) policy will be paid separately to the insurance company.

Knowing this, it makes good financial sense to select a Medicare Supplement plan you can comfortably afford while keeping in mind the out-of-pocket expenses that you could be responsible for each year.

The Insurance Company

Since Medicare Supplement insurance providers are under the watchful eye of Medicare (CMS), consumers can feel comfortable selecting any company approved in their state.

However, some companies perform better than others when it comes to customer service and claims service. The best way to know which companies stand out in your state is to ask an experienced and reputable independent insurance who will likely represent almost all of the companies authorized to sell Medicare Supplement Insurance.

Since independent insurance agents are not employees of the insurance companies they represent, they will always put the needs of their clients and prospective clients first.

If you live in Massachusetts, Minnesota, or Wisconsin

As was mentioned earlier in this article, residents of Massachusetts, Minnesota, and Wisconsin have a different selection of Medicare Supplement Plans because the government of each of those states has elected not to offer the national standardized plans.

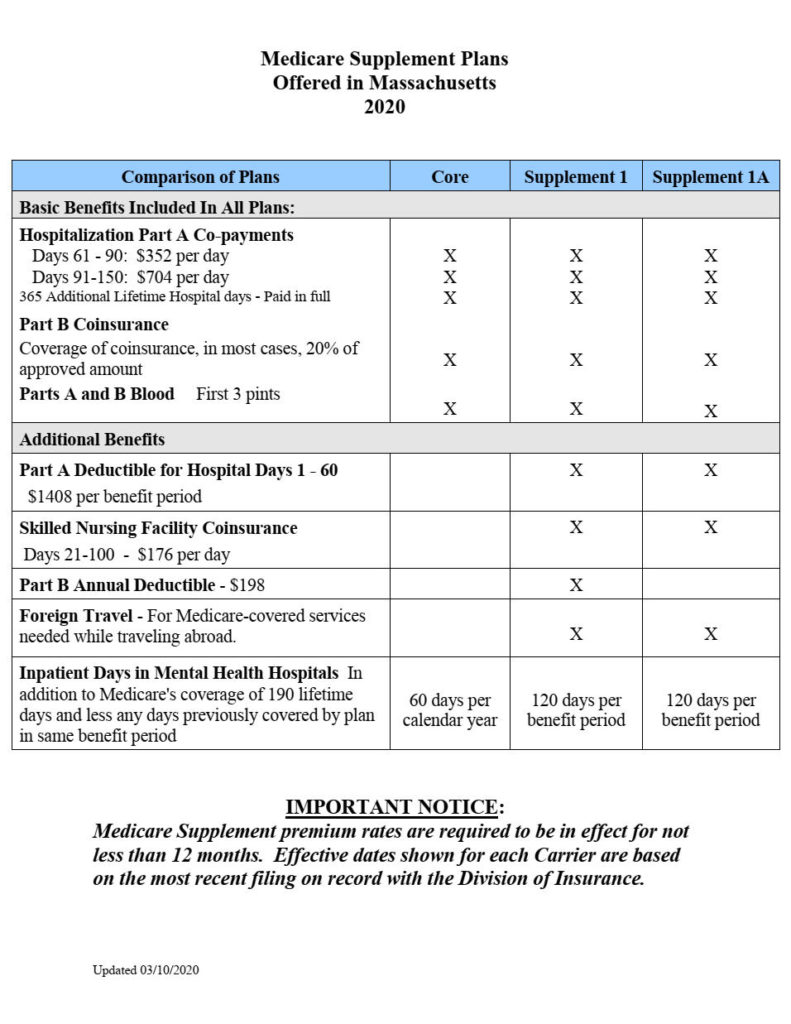

Medicare Supplement Plans Offered in Massachusetts

The state of Massachusetts does not use the national standardized Medicare Supplement Plans. Instead, the state has developed a “Core” plan plus two kinds of supplements that they believe will work best for residents of the state.

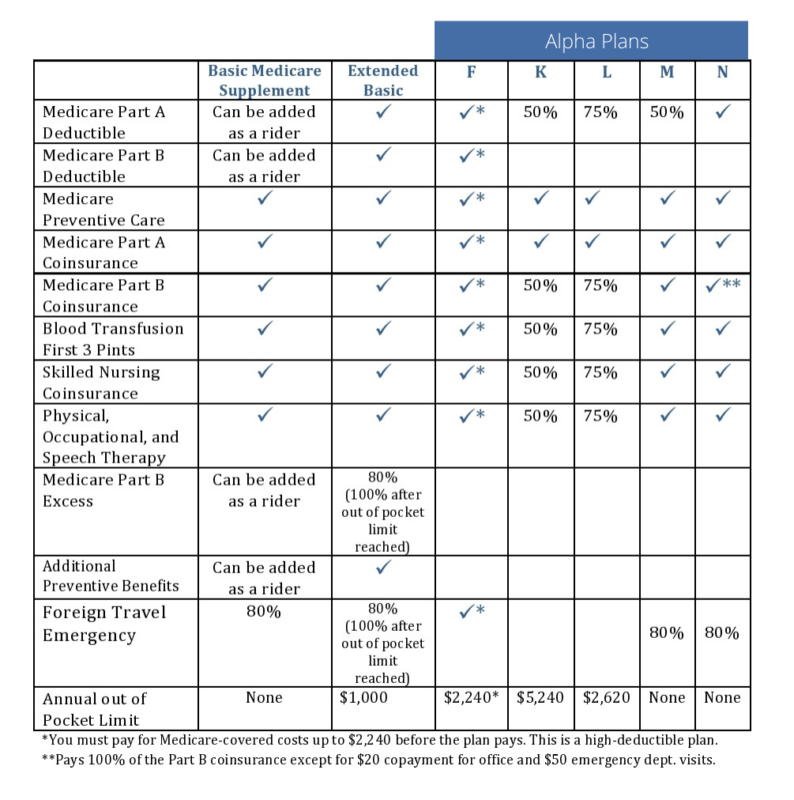

Medicare Supplement Plans in Minnesota

Like Massachusetts, the state of Minnesota offers a select group of plans standardized by the state.

Medicare Supplement Plans in Wisconsin

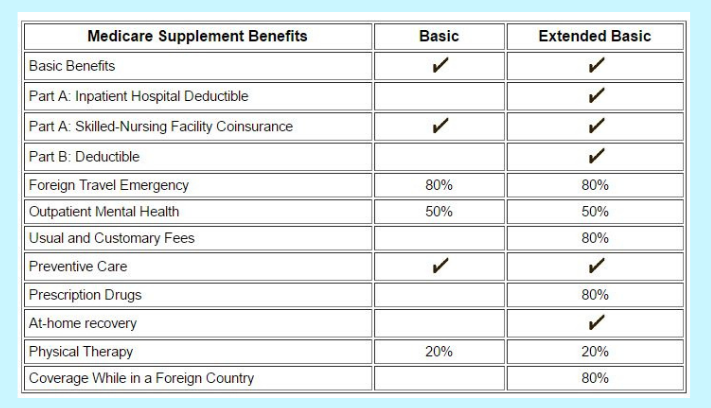

Wisconsin is also one of the three states that opted not to accept the national standardized Medicare Supplement (Medigap) plans.

Residents of Wisconsin are offered a choice of two plans: a Basic Plan and a Cost-Sharing Plan. Several riders can be added to the policy for it to be more comprehensive like the Medigap F, G, and N plans.

Wisconsin Medicare Supplement Plans for 2023

Using this chart of basic and extended coverages, Wisconsin residents can design a Medigap Plan that would be as comprehensive as the national standardized plans F, G, and N.

What Medicare Supplement Plans will Not Cover

Although Medicare Supplement Plans will fill the gaps in your Original Medicare that are the result of deductibles, copayments, and coinsurance, it will not cover everything.

- Prescription Drugs – For this coverage, you will need to purchase Medicare Part D

- Dental – For comprehensive dental coverage you will need to purchase stand-alone dental insurance or elect a Medicare Advantage Plan (Medicare Part C) which typically covers dental services.

- Vision and Hearing – For this coverage, you should consider a stand-alone vision and hearing plan or elect a Medicare Advantage Plan

This should be considered as an overview of Medicare Supplement Plans for 2023. You can find more in-depth information in the blog section of our website.

GET A FREE PLAN COMPARISON!

Book an Appointment with HealthPlans2Go

![]() Medicare Open Enrollment 01/01-03/31

Medicare Open Enrollment 01/01-03/31

![]() Medicare Annual Enrollment 10/15-12/07

Medicare Annual Enrollment 10/15-12/07

![]() U65 Health Insurance Open Enrollment 11/01-01/15

U65 Health Insurance Open Enrollment 11/01-01/15