Medicare Part D

COMPARE PLANSMedicare Part D is the governmental program that provides prescription drug coverage for enrollees.

Although Part D is part of the Original Medicare program, the plans are provided and administered through private insurance companies that have been approved to offer this coverage.

Who can enroll in Medicare Part D?

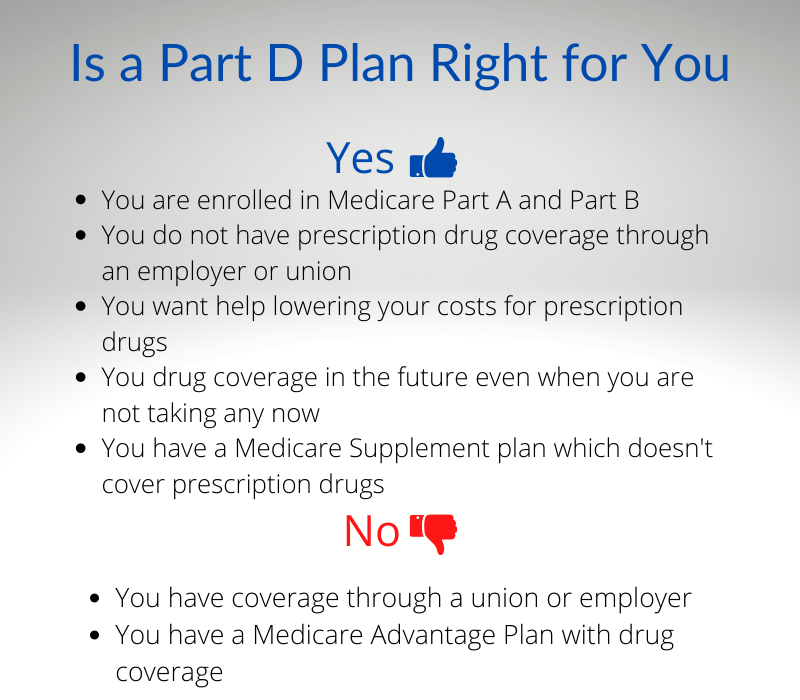

Medicare recipients who are enrolled in Medicare Part A or Part B are eligible to enroll in Medicare Part D prescription drug coverage. The plan is available to eligible individuals regardless of income and no medical exams are required when a policy is purchased.

Most importantly, an applicant cannot be denied coverage for health reasons or if the applicant is already using multiple prescription drugs.

Medicare Part D is voluntary unless you are getting prescription drugs through Medicaid and if so, you must sign up with a Medicare Part D plan as soon as you become eligible for Medicare coverage.

There is no requirement to sign up for Medicare Part D if you currently have drug coverage through an employer or union that is considered as good or better than Medicare’s coverage.

However, if you delay signing up for Part D coverage and are not covered by another plan as good as Medicare Part D, you’ll likely be charged a late penalty and you can only enroll during an annual open enrollment period.

How do I get Part D Coverage?

Any eligible individual can purchase Medicare Part D coverage in one of two ways:

- You can purchase a stand-alone plan (PDP) that only provides prescription drug coverage. Stand-alone plans are primarily intended for individuals who prefer to get health coverage from Original Medicare. For 2021, there are over 900 Part D Stand-Alone plans to choose from.

- You can get Part D coverage that a Medicare Advantage plan that covers medical services and prescription drug coverage in one comprehensive health insurance plan.

How much does Medicare Part D Prescription Drug Coverage Cost?

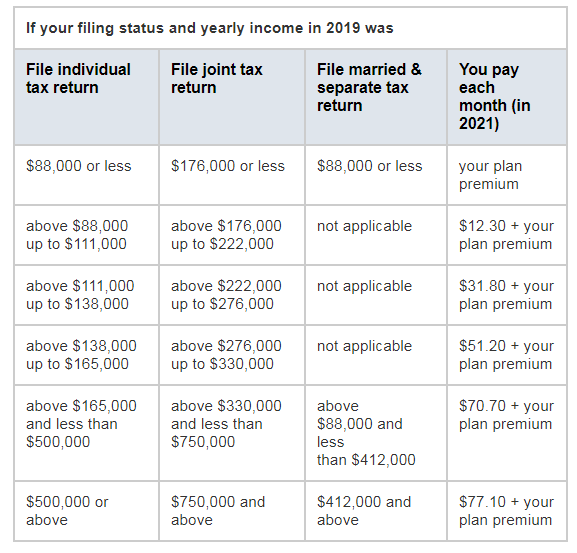

The private insurance companies that offer Part D prescription drug plans set their own rates, deductibles, copayments, and coinsurance amounts. The companies can also surcharge an enrollee according to the Related Monthly Adjustment Amount (IRMAA).

The IRMAA surcharge is generally added to individuals whose adjusted gross income from two previous years is above a certain income threshold. The adjusted gross income threshold for 2021 is $89,000 for single filers and $177,000 for those who file married and filing jointly.

If you are subject to the IRMAA surcharge, this additional amount is not considered part of your Part D premium so the surcharge is paid to the government rather than your insurance company. Most people have the surcharge deducted from their Social Security retirement benefit or you can pay it directly to Medicare.

Here is the IRMAA surcharge schedule for 2021:

What is my share of drug costs under Medicare Part D?

Your out-of-pocket costs are based on several moving parts that make up Medicare Part D plans. Using the standard benefit (minimum coverage allowed), you can expect to pay the following for calendar year 2021:

- Your monthly premium (varies depending on the plan chosen)

- Your annual out-of-pocket deductible before the company starts paying

- Your share of the cost of the prescription (copay or coinsurance) during the initial coverage period until your prescription drug costs (between you and the company) reach the coverage gap threshold ($4,130 in 2021)

- While in the coverage gap (donut hole), your share for generic and brand-name drugs will be no more than 25% until your drug costs (between you and the company) reach $6,550 and you qualify for “catastrophic coverage” where your share of drug costs will go down.

Costs that count towards the coverage gap:

- Your annual deductible, copayments, and coinsurance

- Discounts you receive on brand-name drugs while in the coverage gap

- What you pay in while in the coverage gap

Costs that do not count towards the coverage gap:

- Your drug plan monthly premium

- Any pharmacy dispensing fees

- What you might have to pay for drugs that aren’t covered by your plan

Get Extra Help for Medicare Part D Plans

For individuals that qualify by meeting income and resource limits, you can qualify for the EXTRA HELP program that can dramatically decrease your out-of-pocket expenses for prescription drugs.

The Extra Help program was designed to help Part D enrollees reduce the cost of Medicare Part D premiums, reduce or eliminate annual deductibles, and reduce or eliminate copayments or coinsurance.

If you qualify for Extra Help in 2021, your costs for generic drugs are capped at $3.70 per drug and your cost for branded drugs is capped at $9.20 per prescription.

Do all Part D drug plans offer the Same Coverage?

Although all Medicare Part D drug plans must offer the same minimum coverage, the insurance companies set their own rates and many offer better benefits and have different overall designs.

Most companies arrange drug charges according to the “tier” that each drug is assigned to:

| Tier 1 – Generic drugs | These are the least expensive drugs because they are generic |

| Tier 2 – Preferred Drugs | Preferred drugs are branded, more expensive than generics, and in many cases are more effective than generic drugs |

| Tier 3 – Non-Preferred | These are brand name drugs but not considered the most effective |

| Tier 4 – Specialty Drugs | Specialty drugs are typically the most expensive drugs in the marketplace and generally require a substantial coinsurance amount |

What is a Special Election Period?

The Special Election Period (SEP) gives you an additional opportunity to enroll, change, or disenroll from your existing Part D coverage. The typical events that qualify an individual for the Special Election Period are:

- Your current Part D insurance company is no longer contracted with Medicare.

- You have had creditable prescription drug coverage through an employer but are losing it.

- You are moving to an area that your current Part D provider does not service.

- You are qualified for Medicare Extra Help.

- You will be living in a nursing or hospice facility.

Medicare provides other situations when you can qualify for a Special Election Period which can be reviewed on the Medicare website.

What is the 5-Star Special Election Period?

Private insurance companies that are approved to offer Medicare Part D coverage are graded on a rating system that was established by Medicare.

The 5-Star rating system assigns a rating of 1 to 5 for grading an insurer’s quality of service with a 5 (excellent) being the highest available.

If the insurance company that you have your Part D coverage with does not qualify for a 5-star rating or if the company’s rating has been downgraded from a 5-star rating, you can change insurance companies once each year from December the 8th to November the 30th of the following year.

GET A FREE PLAN COMPARISON!

Book an Appointment with HealthPlans2Go

![]() Medicare Open Enrollment 01/01-03/31

Medicare Open Enrollment 01/01-03/31

![]() Medicare Annual Enrollment 10/15-12/07

Medicare Annual Enrollment 10/15-12/07

![]() U65 Health Insurance Open Enrollment 11/01-01/15

U65 Health Insurance Open Enrollment 11/01-01/15